Did you know that nearly 65% of small businesses rely on loans for their operations, and a strong credit score is often the key to securing these vital financial lifelines?

A strong credit score is essential for success in today’s competitive corporate world. Fortunately, new artificial intelligence developments have opened the door for creative approaches to credit restoration. Businesses can easily raise their credit scores, gain access to better financing options, and draw in investors with AI-powered credit restoration software.

The use of AI in business credit restoration is expected to grow significantly in the future, completely changing how businesses maintain their credit histories. Potential advancements could involve the application of increasingly complex algorithms designed to provide individualized credit enhancement tactics. These algorithms can analyze enormous volumes of financial data to pinpoint precise issues influencing credit ratings and provide specialized recommendations for properly solving them.

Additionally, improvements in sentiment analysis and natural language processing (NLP) technology can make AI credit restoration software more precise in analyzing customer conversations and complicated financial paperwork. AI systems can offer more intelligent suggestions for credit repair tactics because they comprehend the subtleties of language used in credit reports and correspondence with financial organizations.

AI-powered credit repair software combines sophisticated algorithms, better data analysis tools, and improved communication features to enable businesses to proactively raise their credit scores and maintain sound financial profiles.

Key Takeaways:

- AI credit repair software can significantly improve efficiency by automating time-consuming credit report analysis and dispute resolution tasks

- Early identification and intervention regarding discrepancies can minimize the negative impact on a business’s credit score

- AI-powered solutions can be particularly helpful in addressing complex issues like fraudulent activity on credit reports

Understanding Credit Scores

In the world of business and finance, credit scores serve as a critical metric that can make or break opportunities for growth and expansion. A credit score reflects a business’s creditworthiness and ability to fulfill financial obligations. Much like personal credit scores, business credit scores are numerical representations based on various financial factors.

Factors Contributing to Business Credit Scores

A couple of different factors contribute to business credit scores. Here are the current contributing factors that make or break a business’s credit score.

Payment History

Payment history is one of the most critical factors influencing a business’s credit score. It reflects whether a business makes timely payments on its bills, loans, and credit card balances. Consistently paying bills and debts promptly demonstrates reliability and financial responsibility to creditors and lenders. On the other hand, late payments or defaults can significantly damage a business’s credit score, leading to higher interest rates, reduced access to credit, and other financial challenges.

Credit Utilization

Credit utilization refers to the ratio of credit used to the total available credit. It plays a crucial role in determining a business’s credit score. Keeping credit utilization low indicates responsible financial management and may positively impact credit scores. On the other hand, high credit utilization suggests a higher risk of overextension and may negatively affect credit scores. Lenders typically prefer to see businesses using a smaller percentage of their available credit, indicating a lower risk of default.

Length of Credit History

The length of a business’s credit history is another essential factor in determining its credit score. A longer credit history gives creditors and lenders more data to assess the business’s financial behavior and repayment patterns. Businesses with longer credit histories may be viewed as more stable and less risky borrowers, potentially leading to higher credit scores. Conversely, new businesses or those with limited credit histories may need help establishing credibility with creditors and may have lower credit scores.

Credit Mix

The diversity of credit accounts, including loans, credit cards, and lines of credit, also influences a business’s credit score. A healthy mix of credit types demonstrates that a business can manage various financial obligations responsibly. For example, having both installment loans and revolving credit accounts may be viewed more favorably than relying solely on one type of credit. Lenders may perceive businesses with a diverse credit mix as lower risk and may be more inclined to extend credit or offer favorable terms.

Public Records and Collections

Negative public records such as bankruptcies, tax liens, judgments, and outstanding collections can significantly impact a business’s credit score. These records indicate financial distress or legal issues and may raise concerns for creditors and lenders about the business’s ability to repay debts. Businesses with public records or collections may face challenges in obtaining credit or may be subject to higher interest rates and less favorable terms. It’s essential for businesses to address and resolve any outstanding public records or collections to improve their credit scores and financial standing.

Importance of Good Credit Scores for Businesses

Maintaining a favorable credit score is essential for businesses seeking financial stability, growth opportunities, and industry credibility. A high credit score can lead to:

Access to Capital

A good credit score enhances a business’s ability to secure loans, lines of credit, and financing options from banks, lenders, and investors.

Competitive Advantage

Businesses with strong credit profiles are more attractive to potential partners, suppliers, and clients, fostering trust and confidence in business relationships.

Lower Interest Rates

A favorable credit score may result in lower interest rates and favorable loan terms, reducing the overall cost of borrowing capital.

Business Expansion

With access to financing, businesses can invest in expansion initiatives, purchase equipment, hire employees, and explore new market opportunities.

Traditional Credit Repair for Businesses

Traditional methods of business credit repair often involve manual review and dispute submission of credit reports, which can be a time-consuming and resource-intensive process. Typically, businesses would

Obtain Credit Reports

Businesses start by obtaining their credit reports from major credit bureaus like Experian, Equifax, and Dun & Bradstreet. These reports detail the business’s credit history, including payment history, credit utilization, and any derogatory marks.

Manual Review

Upon receiving credit reports, businesses manually review each entry to identify inaccuracies, errors, or outdated information that may negatively impact their credit scores. This process requires careful scrutiny and attention to detail to spot discrepancies.

Dispute Submission

Once errors or inaccuracies are identified, businesses initiate dispute procedures with the credit bureaus to correct the information. This often involves submitting formal dispute letters, online dispute forms, and supporting documentation to substantiate the claims.

Follow-Up and Resolution

After disputing inaccuracies, businesses must follow up with the credit bureaus to ensure that corrections are made promptly. This may require additional correspondence and documentation to support the claims made in the dispute.

Challenges of Traditional Credit Repair

Despite these challenges, businesses have traditionally relied on these methods to address credit concerns and improve their credit profiles. However, technological advancements, particularly the emergence of AI-powered credit repair software, offer a more streamlined and efficient approach to business credit repair.

Time-Consuming Process

The manual nature of traditional credit repair methods often results in inefficiencies and delays, prolonging the time it takes to address credit issues and improve scores. Manual review and dispute submission can be time-consuming, diverting valuable resources and attention away from core business activities.

Potential for Errors

Human error and oversight are inherent risks in the traditional credit repair process, leading to missed opportunities for improvement or unresolved disputes. When credit repair tasks are performed manually, there is a higher likelihood of errors such as incorrect data entry, overlooking critical details on credit reports, or failing to follow up on dispute resolutions in a timely manner. These errors can significantly impact the credit repair process’s effectiveness and delay achieving desired credit score improvements.

Limited Expertise

Businesses may lack the expertise or specialized knowledge required to effectively navigate the complexities of credit reporting and dispute resolution.

Credit repair often involves understanding intricate credit laws, regulations, and procedures, interpreting credit reports, and identifying errors or inaccuracies. Without access to credit repair professionals, businesses may struggle to develop effective strategies, identify optimal dispute opportunities, or negotiate with creditors and credit bureaus. As a result, they may face challenges in achieving meaningful improvements to their credit profiles and may not maximize their potential for financial growth and success.

Inefficiency

Traditional credit repair methods may lack innovation and fail to leverage technology advancements to their full potential. As a result, businesses may miss out on opportunities to optimize their credit repair processes and achieve faster, more effective results.

The Significance of AI in Credit Repair

In recent years, artificial intelligence (AI) has emerged as a game-changer in various industries, including credit repair. AI credit repair software leverages advanced algorithms and machine learning techniques to revolutionize how businesses address credit issues. AI software significantly enhances efficiency and effectiveness in credit repair processes by automating tedious tasks, offering personalized strategies, and providing real-time updates.

Capabilities of AI Credit Repair Software

AI credit repair software is equipped with powerful capabilities that enable it to analyze credit reports from major bureaus, such as Experian, Equifax, and TransUnion. Through sophisticated machine learning algorithms, the software can swiftly identify errors, inaccuracies, and discrepancies that may be negatively impacting a business’s credit score. This automated analysis ensures a thorough examination of credit profiles, surpassing the limitations of manual reviews.

Personalized Strategies for Credit Improvement

A notable feature of AI credit repair software is its ability to formulate personalized strategies for credit improvement. By scrutinizing a business’s credit history, payment patterns, and financial behaviors, AI algorithms can pinpoint areas for enhancement and recommend actionable steps to boost credit scores. These tailored strategies consider each business’s unique circumstances and objectives, offering targeted credit repair and optimization solutions.

Providing Proactive Monitoring and Real-time Updates

AI credit repair software offers businesses the advantage of proactive monitoring and real-time updates. By continuously monitoring credit profiles, businesses can promptly identify changes, errors, or negative events affecting their credit scores. This proactive approach enables businesses to address issues swiftly and mitigate potential damage to their credit standing. Additionally, real-time updates ensure that businesses stay informed about their credit status, empowering them to make informed decisions in a timely manner.

Optimizing Dispute Resolution with Predictive Analytics

Another key aspect of AI credit repair software is its use of predictive analytics to optimize dispute resolution. By analyzing historical data and patterns, AI algorithms can predict the likelihood of success for various dispute strategies. This predictive capability allows the software to prioritize disputes with higher chances of success, maximizing the efficiency and effectiveness of the credit repair process. Businesses can achieve faster results and expedite credit score improvement through data-driven decision-making.

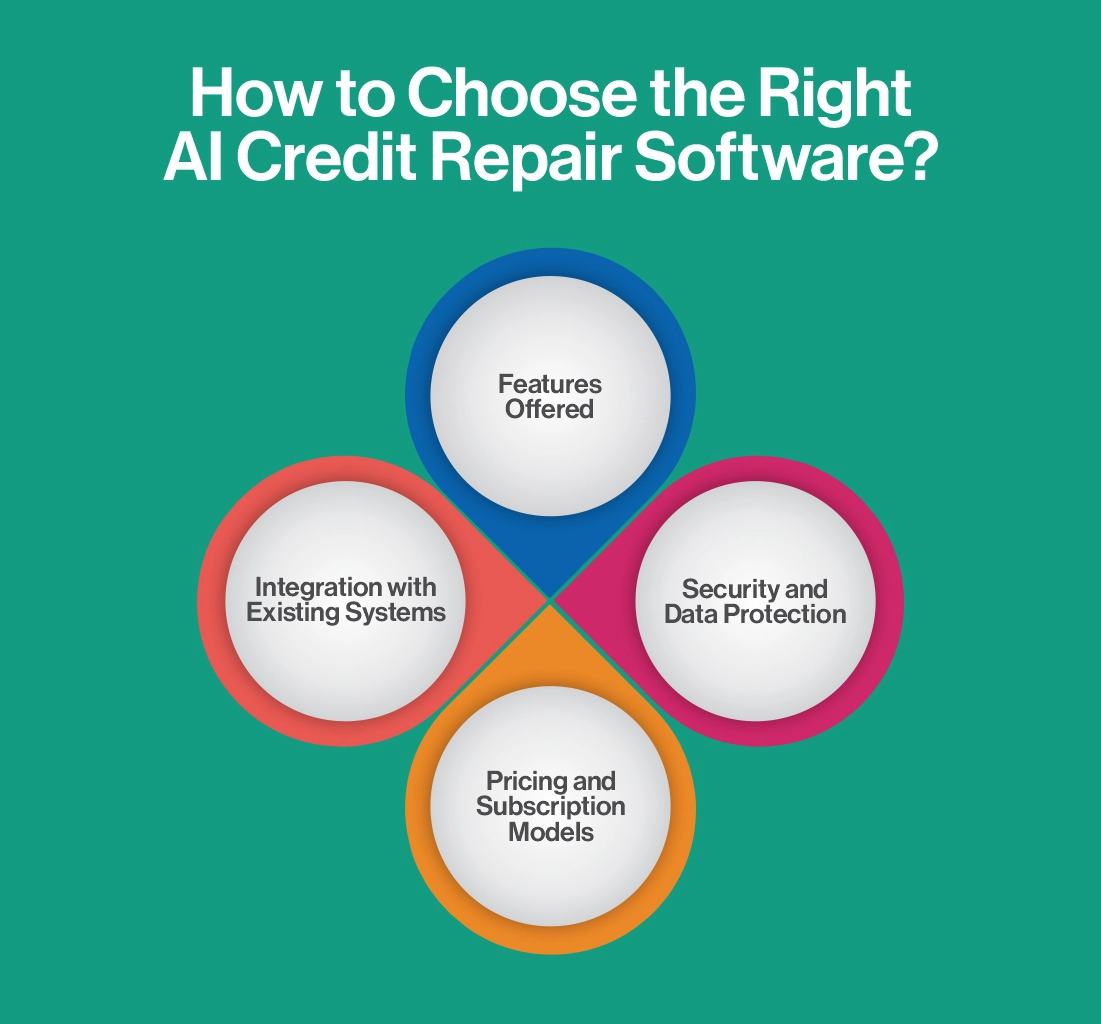

How to Choose the Right AI Credit Repair Software?

When selecting AI credit repair software for your business, it’s essential to consider several factors to ensure you’re making the best choice.

By carefully evaluating these factors and conducting thorough research, you can select the right AI credit repair software that meets your business’s needs, enhances your credit repair efforts, and contributes to your overall financial success.

Here’s a checklist of key considerations:

Features Offered

Evaluate the features the AI credit repair software offers, such as dispute automation, credit report monitoring, personalized credit improvement strategies, and real-time updates. Choose a software solution that aligns with your business’s specific credit repair needs and goals.

Security and Data Protection

Prioritize the security of your sensitive financial information. Look for AI credit repair software that implements robust security measures, such as data encryption, secure data storage protocols, and compliance with industry regulations like GDPR or HIPAA. Verify the software provider’s reputation for safeguarding customer data.

Integration with Existing Systems

Consider whether the AI credit repair software integrates seamlessly with your existing accounting or financial systems. Compatibility with your current software infrastructure can streamline workflows and enhance efficiency. Look for software solutions that offer easy integration through APIs or third-party integrations.

Pricing and Subscription Models

Assess the pricing structure and subscription models offered by different AI credit repair software providers. Compare pricing plans based on factors such as the number of users, volume of credit reports processed, and additional features included. Choose a pricing plan that offers the best value for your business while remaining within your budget constraints.

Limitations of AI Credit Repair Software

While AI credit repair software offers significant advantages in automating and streamlining credit repair processes, it’s essential to recognize its limitations.

By acknowledging these limitations and selecting a reputable AI credit repair software provider with transparent practices and customer support, businesses can leverage AI technology to enhance their credit repair efforts while ensuring accountability and reliability in the process.

Here are some factors to consider:

Human Intervention May Be Required

Despite the advanced capabilities of AI algorithms, there are instances where human intervention may be necessary. Complex credit issues or disputes that require nuanced judgment may benefit from human oversight and decision-making. Additionally, AI software may not always accurately interpret certain credit report data or understand contextual nuances, highlighting the importance of human expertise in credit repair efforts.

Dependence on Data Quality

The quality and accuracy of the data that AI credit restoration software processes significantly impacts its efficacy. Incomplete or inaccurate credit report data can result in incorrect dispute suggestions or credit improvement tactics that don’t work. Businesses need to ensure that the information in their credit reports is correct and current to get the most out of AI-driven credit restoration solutions.

Transparency and Customer Support

When selecting an AI credit repair software provider, choosing a reputable company with transparent practices and robust customer support is crucial. Businesses should have access to clear documentation and explanations of how the AI algorithms operate and responsive customer support channels for addressing any questions or concerns. Transparency and open communication with the software provider can help businesses effectively navigate any limitations or challenges encountered during credit repair processes.

The Future of AI in Business Credit Repair

The future of AI in business credit repair holds promising advancements that can revolutionize how companies manage and improve their credit scores.

Overall, the future of AI in business credit repair holds great potential for helping companies navigate the complexities of credit management more effectively. With advancements in algorithm sophistication and integration capabilities, businesses can expect to benefit from more personalized strategies and faster dispute-resolution processes, ultimately leading to improved financial health and more significant opportunities for growth.

Here are some potential developments:

Introduction to Sophisticated Algorithms

As AI technology continues to evolve, we expect to see the development of more advanced algorithms capable of analyzing vast amounts of data to provide highly personalized credit improvement strategies. These algorithms will consider factors such as industry trends, financial performance, and credit history to tailor strategies that address each business’s unique credit challenges.

Enhanced Integration with Financial Institutions for Faster Dispute Resolution

In the future, AI-powered credit repair software may feature enhanced integration capabilities with financial institutions and credit bureaus. This integration would enable real-time data sharing and communication, allowing businesses to expedite the dispute resolution process. By streamlining communication channels and automating data exchange, businesses can resolve credit disputes more efficiently, improving their credit scores quicker.

The Best Credit Repair Software Tools

Credit repair software tools allow businesses to streamline the credit repair process, identify inaccuracies, and improve credit scores efficiently. Here are the top five credit repair software tools that businesses can leverage to enhance their credit profiles and unlock new opportunities for growth.

Credit Repair Cloud

Credit Repair Cloud is a comprehensive credit repair software platform that empowers businesses to launch, manage, and scale their operations efficiently. It offers features such as client management, automated dispute generation, customizable workflows, and progress tracking. With Credit Repair Cloud, businesses can streamline their credit repair processes and deliver exceptional results for their clients.

DisputeBee

DisputeBee is a user-friendly credit repair software tool that simplifies the dispute process for businesses. It offers features such as credit report importation, dispute letter generation, client management, and real-time progress tracking. DisputeBee’s intuitive interface and automation capabilities make it an ideal choice for businesses looking to improve their credit scores effectively.

ScoreCEO

ScoreCEO is a strong credit repair software platform that provides businesses with the tools they need to succeed in the credit repair industry. It offers features such as client management, credit report analysis, dispute letter generation, and marketing automation. ScoreCEO’s comprehensive suite of features and customizable workflows make it a top choice for businesses looking to optimize their credit repair processes.

TurboDispute

TurboDispute is a powerful credit repair software solution designed to streamline the dispute process and maximize results for businesses. It offers client onboarding, credit report analysis, dispute letter customization, and progress tracking features. TurboDispute’s advanced analytics and reporting capabilities provide businesses with valuable insights to optimize their credit repair strategies effectively.

Credit Detailer

Credit Detailer is a versatile credit repair software tool that offers businesses a range of features to improve their credit scores. It provides features such as credit report importation, dispute letter generation, client management, and progress tracking. Credit Detailer’s user-friendly interface and customizable workflows make it an ideal choice for businesses of all sizes.

Conclusion

By leveraging AI credit repair software, businesses can gain valuable time and resources while ensuring the accuracy of their credit reports. Improved credit scores translate to better loan terms, access to additional capital, and, ultimately, more vigorous financial health for businesses of all sizes. As AI technology continues to evolve, we can expect even more sophisticated solutions tailored to the specific needs of businesses in their pursuit of a healthy credit standing.

Fiverivers Technology, a leading provider of innovative AI solutions, understands the challenges businesses face in maintaining a positive credit profile. We are actively exploring the development of AI-powered credit repair tools to empower businesses to achieve financial success.

FAQs

Can AI fix Credit Rating?

Yes, AI can potentially improve credit rating systems by analyzing vast amounts of data more efficiently and accurately, leading to more personalized and fair assessments of creditworthiness.

How is AI Used in Credit Rating?

AI is used in credit rating to:

- Analyze vast amounts of data from various sources

- Identify patterns and correlations related to creditworthiness

- Automated decision-making processes for loan approvals

- Provide more accurate risk assessments

- Personalize credit scoring models based on individual behavior and financial history